Experience the freedom of clean, comfortable air, from 30-40% Off.

Letter of Medical Necessity provided (typically $25+) free of charge.

How it Works:

-

01

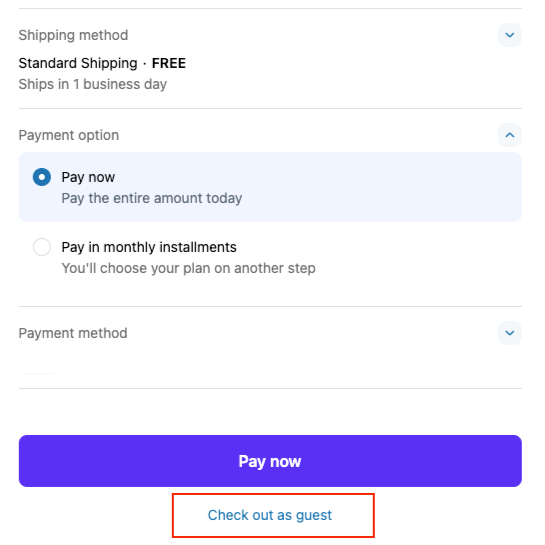

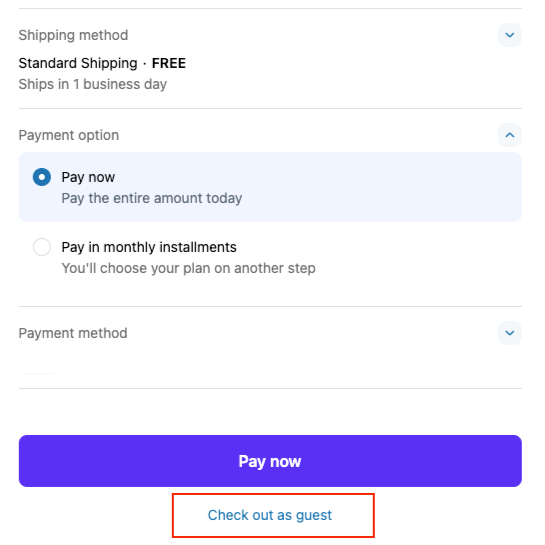

If you have a "Shop" account logged in, make sure you checkout as guest as shown above

-

02

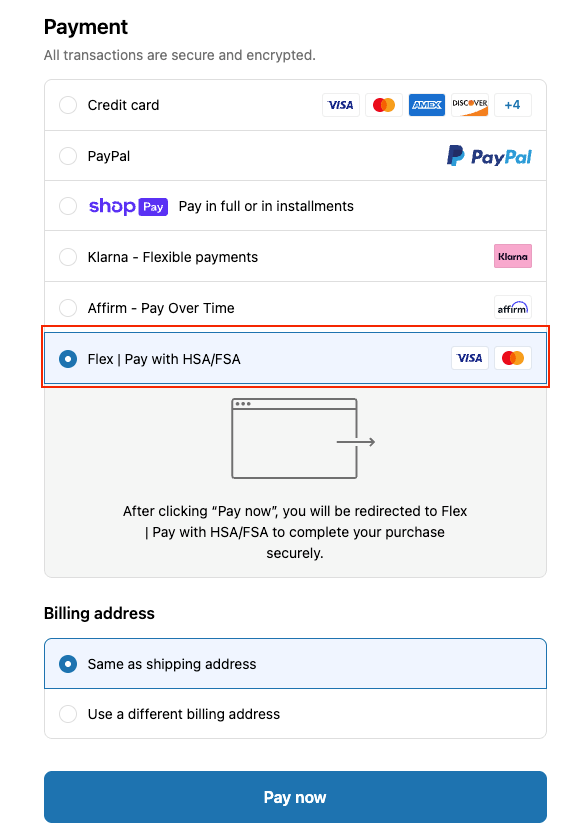

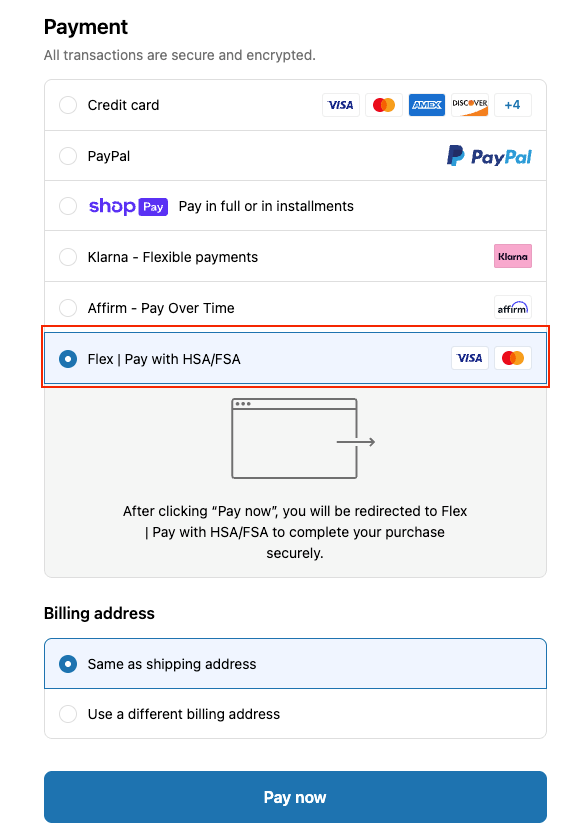

At checkout, under “Payment” select Flex | Pay with HSA/FSA

-

03

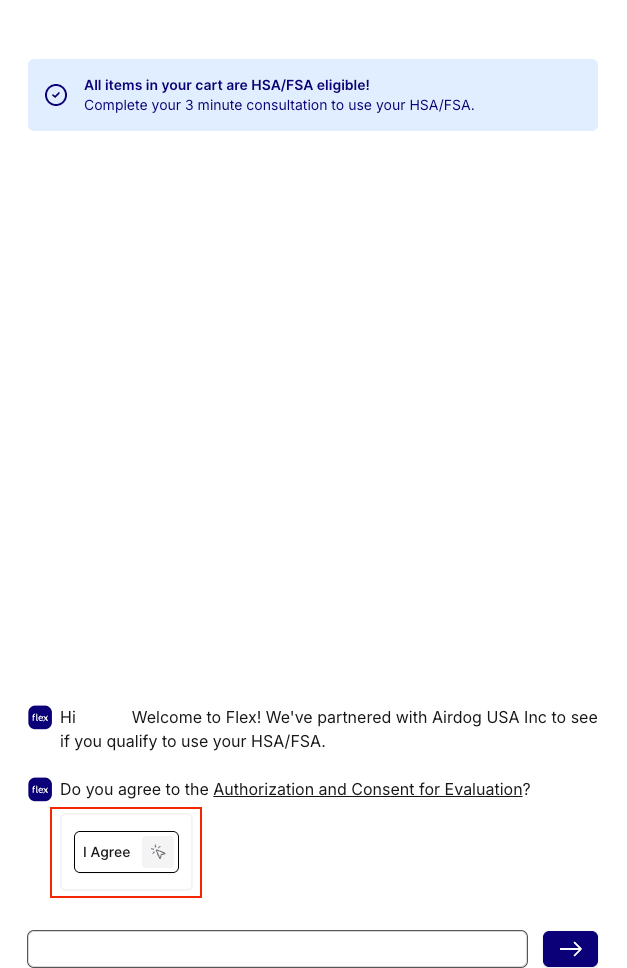

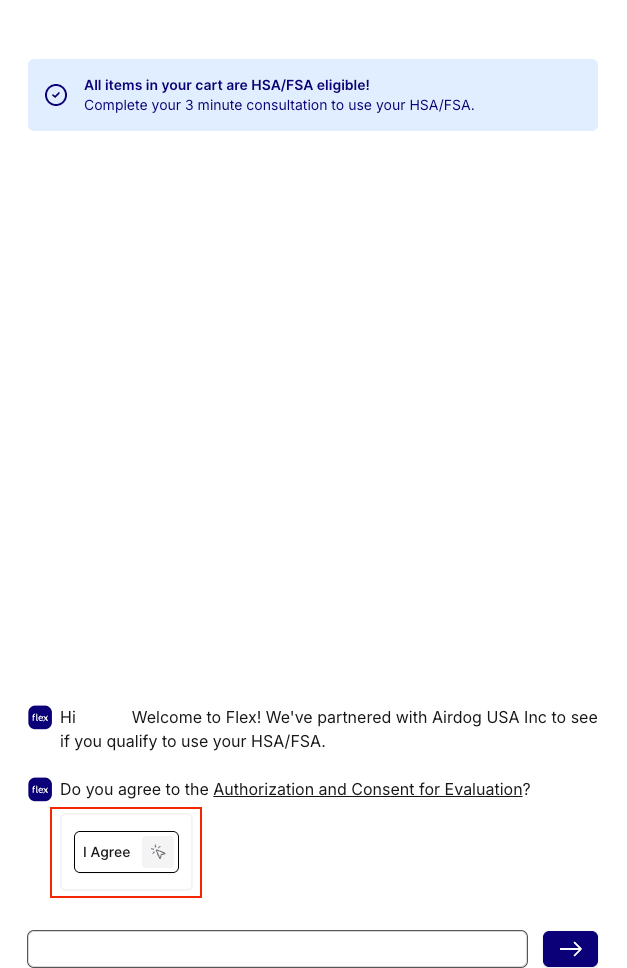

Provide your consent to a questionnaire for "Letter of Medical Necessities" (essential for reimbursement)

-

04

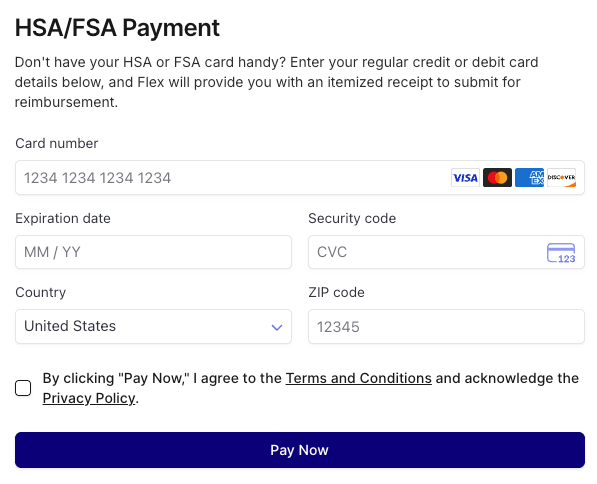

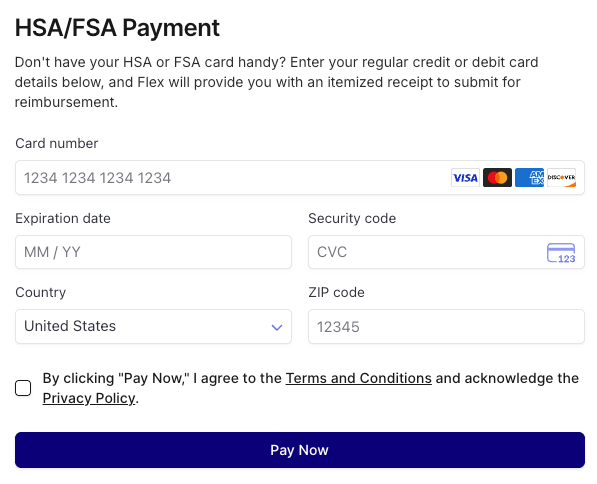

Provide your payment method, and if qualified, a Letter of Medical Necessity will be emailed to you to submit for reimbursement proof

Invest in better health

Many people don’t realize that certain air purifiers may qualify as medical expenses under HSA or FSA guidelines. If a device is used to alleviate or prevent a medical condition, it can often be purchased using these pre-tax funds—which can help reduce your taxable income. Airdog air purifiers are designed to improve indoor air quality by capturing airborne particles such as dust, pollen, and bacteria. This cleaner air can support respiratory health and help create a safer environment for those with allergies, asthma, or other sensitivities. Using HSA or FSA funds for an eligible air purifier is a smart way to invest in your well-being while making the most of your health benefits. Shop FSA and HSA-eligible products!

How Airdog Works to Deliver Cleaner, Healthier Air with HSA/FSA Benefits

-

1. Advanced Air Filter Technology

Airdog air purifiers use a patented TPA® system instead of traditional HEPA filters. This technology generates a high-voltage electrostatic field to attract and destroy airborne particles. Unlike HEPA filters, which can clog and degrade over time, Airdog’s washable, reusable air filter plates maintain consistent performance while cutting down on waste and replacement costs.

-

2. A Health-Focused Investment

When used to manage conditions like allergies or asthma, an air purifier may qualify as an eligible healthcare expense under many HSA or FSA plans. Because Airdog purifiers help reduce exposure to airborne triggers, they can support respiratory health and overall wellness. Before making a purchase, speak with your healthcare provider or plan administrator to confirm your HSA or FSA options.

-

3. Support for Your Immune System

Cleaner air reduces the burden on your lungs and helps protect your immune system from constant exposure to indoor pollutants. Airdog purifiers remove harmful particles like smoke, dust, mold spores, and bacteria, down to 0.0146 microns. This helps create a safer environment for individuals with sensitivities or weakened immune systems, especially in homes with pets, young children, or frequent visitors.

-

4. Enjoy Peace of Mind

Airdog purifiers are designed to work hard in the background, so you can focus on living. The reusable filter system maintains high performance while keeping maintenance low. With fewer particles in the air and no ongoing filter subscriptions to manage, it’s easy to enjoy peace in your space. Just clean the plates, power the unit back on, and breathe easier every day.

Letter of Medical Necessity FAQs

Below are common questions related to your Letter of Medical Necessity.

What is a Letter of Medical Necessity?

Why do I need to provide Airdog with health information?

Do I need to do anything with my Letter of Medical Necessity?

Help! I mistakenly entered my name and/or date of birth and need to get an updated letter. Who can I reach out to?

The date on my Letter of Medical Necessity is one day different from my receipt.

My FSA says I need a product name, NPI number, other info added to my Letter for approval.

Help! I did not receive an itemized receipt and/or Letter of Medical Necessity from Flex. What should I do?

HSA/FSA reimbursement questions

Below are common questions related to the reimbursement process of your HSA/FSA claims

My HSA/FSA claim was denied. What should I do?

Can a customer purchase a product now and apply for FSA reimbursement in the next calendar year?

Can old (non-Flex) customers use their order confirmation email to apply for HSA/FSA reimbursement?

General HSA/FSA FAQs

Below are common questions related to HSA/FSA payments.

What is Flex and what is their relationship with Airdog?

How do I pay with my HSA or FSA card?

What if I don’t have my HSA/FSA card available?

Why can’t I see Flex as a payment method?

Why is my HSA/FSA card being declined?

I submitted my Flex itemized receipt for reimbursement and my FSA requires more information.

Help! I didn’t receive an email from Flex with my itemized receipt and/or letter of medical necessity. What should I do?

I would like to use multiple HSA/FSA cards to pay for an item. Can I do that?

My purchase receipt from Airdog has a different number than what my FSA was charged. How can we resolve it?

Is sales tax covered by HSA/FSA funds, or is it treated separately?